reverse tax calculator uk

Amount with VAT UK VAT UK VAT UK Amount without TVA UK Formulas to calculate the United Kingdom VAT Here is how the total is calculated before VAT. Use the reverse vat calculator on this page to calculate the price less VAT.

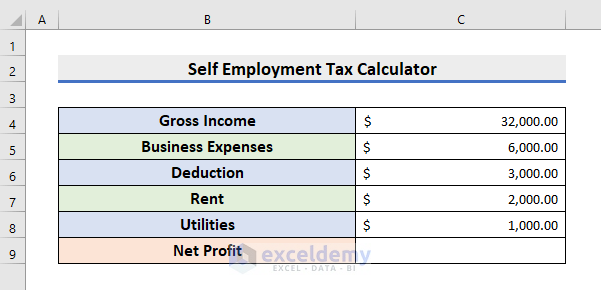

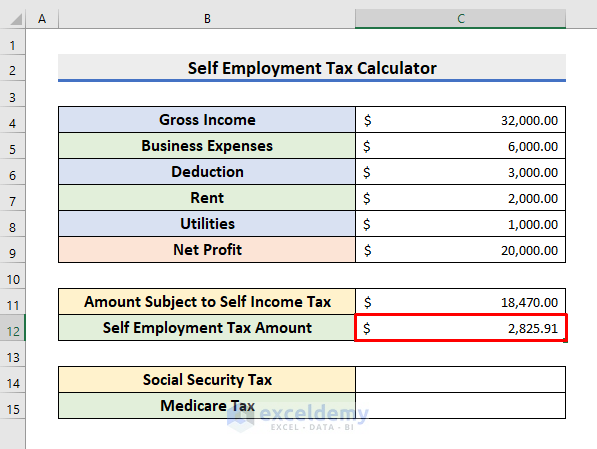

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

State that the VAT is to be accounted by the customer.

. Yes simply divide your GROSS amount by 12. All taxes ERs EEs Fees and Expenses. This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered.

10000 20000 30000 40000 50000 60000. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Instead of using the reverse sales tax calculator you can compute this manually.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. For example the UK VAT rate is 20 which means you would do pricefigure X 12 3. Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct.

To find the original price of an item you need this formula. This works for a 20 VAT rate. You can work out VAT in two ways by removing reversing VAT or adding including VAT.

Even if youre considering different mortgages we can give you something to think about. Here are the. Arnold Shields We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. To add 20 VAT to 10000 simply multiply 10000 x 12 12000 But calculating what is the VAT portion of 12000 is not as simple as taking 20 of 12000 which leaves 9600. All taxes ERs EEs Fees and Expenses.

You can use this method to find the original price of an item after a discount or a decrease in percentage. We will illustrate the differences between using an umbrella company to handle payslips to setting up your own limited company PSC and check the tax implications of being inside IR35 or outside IR35. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

For the reduced VAT rate of 5 divide the GROSS figure by 105. Adding Including VAT Formula 1. Income Tax Calculator How much tax will I pay.

Add wording to the invoice to say customer. UK Tax Salary Calculator. You also have the option to get the figures for Annual monthly weekly and daily pay.

An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions. This tells you your take-home pay if you do not have. Reverse Tax Calculator Contractor Tax Calculator If you are a contractor working inside IR35 under an umbrella company you can use this calculator to accurately generate payslips and a pay summary for any contract from April 2009.

Our tax calculator calculates your personal tax free allowance. If your software cannot show the amount of VAT to account for under reverse charge you must. Your Results Read a full breakdown of the tax you pay.

Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. How do I calculate VAT backwards in Excel. Reverse VAT calculator in UK for 2022 Free calculator of inverted taxes for United Kingdom Do you like Calcul Conversion.

The tax calculator will help you see how the governments deductions impact what you get to take home. Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of income. Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year.

Tax year. This calculation is used on a regular basis by Personal Injury and Family Law lawyers. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

The Salary Calculator is designed to help you get a hold of your finances. Calculator formula Here is how the total is calculated before sales tax. Use this fast easy to use and in-depth tax calculator to see the differences between take home income and deductions for a contracting job.

See how much Income Tax you paid last tax year 6 April 2021 to 5 April 2022 If youre self. Use this service to estimate how much Income Tax you should have paid for a previous tax year. Once you have input these into the net to gross salary calculator simply press the compute button to obtain the figures.

Pay as you earn tax. Amount with VAT 1 VAT rate 100 Amount without VAT. For example 100 is the price X 12 120 which is now the pricefigure including VAT.

Reverse Sales Tax Formula. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses Calculators Canada sales tax GSTHST remittance calculator. You will get the figures for.

Personal Tax Free Allowance Table of personal tax free allowance by tax year. Contractor Tax Calculator Income Tax Calculator. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales. Contractor Tax Calculator Income Tax Calculator. VAT Percentage 2.

Can I use a calculator to calculate reverse VAT. More information about the calculations performed is available on the about page. Multiply the pricefigure by 1.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. The reduction in the standard rate of VAT from 175 to 15 was prompted by the recent financial turmoil in the global financial system in 2008 and increased to 20 in January 2011. Adding 20 VAT is a straightforward calculation but reverse VAT can be tricky Adding 20 VAT to a price is easy simply multiply by 12 eg.

Value Added Tax was introduced in 1973 as a replacement for Purchase Tax and Selective Employment Tax as a condition of UK entry into the European Economic Community. Tax Rates 202223 IMPORTANT. Reverse Tax Calculator Contractor Tax Calculator If you are a contractor working inside IR35 under an umbrella company you can use this calculator to accurately generate payslips and a pay summary for any contract from April 2009.

You can use tax rates from 2013 to 2002 and specify either weekly or annual net after Tax earnings.

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Setting Up Taxes In Woocommerce Woocommerce

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

How To Calculate Income Tax In Excel

Microsoft Access Form Template Awesome Microsoft Access Templates And Database Examples Mortgage Loan Calculator Loan Calculator Document Management System

Ultimate Corporation Tax Calculator 2022

Britain S Cost Of Living Crisis Continues As Wages Squeezed Descrier News

How To Calculate Income Tax In Excel

Excel Formula For Reverse Tax Calculation

How To Calculate Income Tax In Excel

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Income Tax In Excel

Uk Tax Calculators Amazon Com Appstore For Android

Uk Tax Calculators Apps On Google Play

Tip Sales Tax Calculator Salecalc Com